Venture capital that will push you further

We aid interesting Czech and Slovak ideas and start-up companies to break through at home and abroad. We do not know a better feeling than to be at the origin of real success from the very beginning, and overcome the challenges that arise along the way one step at a time.

We invest in start-ups both ourselves as angel investors, or through the network of partner VC investors. Furthermore, we are opening the doors to extensive rounds of fundraising for larger companies. Our offer does not end with capital; we provide a carefully built portfolio of contacts and our expertise, together with decades of experience of our investment partners and experts in the sector. Of course, for us, there is the possibility of regular mentoring and sharing our knowledge, which relates to business — business, law, finance, or taxes.

-

Fundraising and venture capital

Do you have an interesting idea and high ambition? We understand that the start-up’s beginnings are impossible without capital. We invest in promising projects, but we can also offer investment opportunities to other investors, our partners and clients, which increases your chances of success.

-

Networking

We will not brag about whom we play golf with or have a drink at the bar. However, if a meeting with someone from the investment world helps your project, it is likely that we will be able to connect you directly, or we will find the way of connection through our contacts and partners.

-

Mentoring

As investors and advisors, we will tell you our honest opinion on the business model and financial or business strategy. We will help where appropriate, for example with the forecast of future developments. We do not necessarily try to gain positions in governing bodies — typically, the management and development of the company remains fully in your hands. Above all, we will provide you with support and a professional perspective, not orders or obligation to fill in dozens of different reports or forms with our header.

-

Expansion abroad

On the road to success, sooner or later, you will reach a stage where it can be beneficial to start thinking globally. We will help you prepare your mindset for expansion and, if necessary, we will try to open the door to cooperation with our business partners in London, New York and other places around the world.

-

Keastone

The Keastone tool is designed to connect individual communication and file-sharing applications into one contextually interconnected environment. The start-up, run from the Czech Republic, domiciled in the USA with a development team in India, convinced us with its drive and global ambitions. Currently, the largest investment in our portfolio, in which we act as one of the two lead investors.

-

Socifi

We entered this start-up in the pre-conversion phase. This originally Czech idea for the monetization of Wi-Fi connections and the use of sponsored 4G networks has gone a long way since its establishment in 2012, and is gradually promoting its revolutionary idea abroad as well.

-

ADEM

The educational project and platform ADEM, the Academy of Digital Economics, helps entrepreneurs and young people to educate themselves in the field of digital management. This investment is a typical example of a “smart money” strategy, where we not only provide capital to the start-up, but we provide our expertise in creating the concept and planning for future development.

-

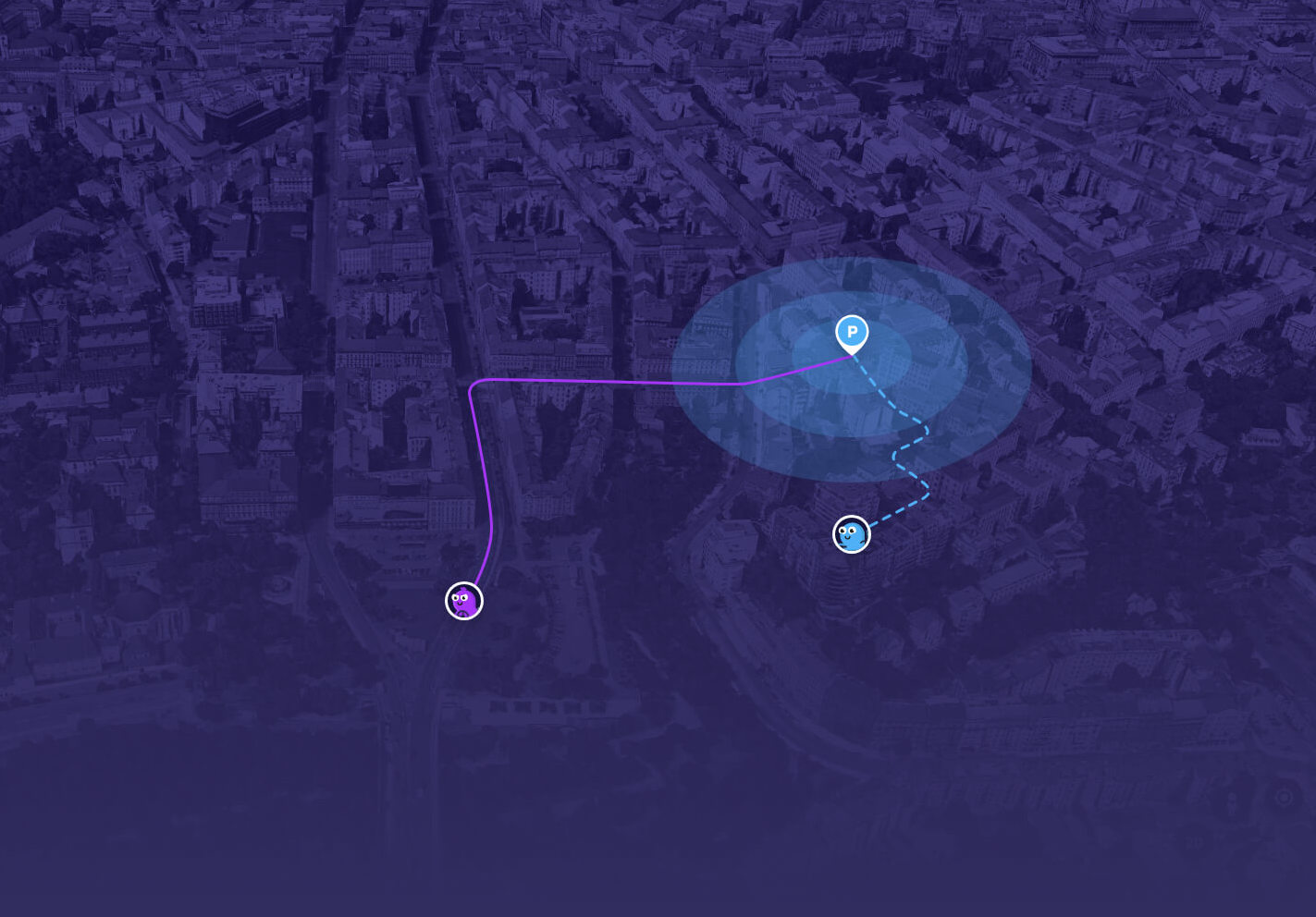

Parking maniacs

Application solving the dilemma of most drivers in big cities — where to park — thanks to advanced technologies and artificial intelligence. Winternitz’s investment in this project also comes in the form of “smart money”, i.e., not only capital, but also help with the development of the business model and the platform itself. This is our newest investment so far, and we cannot wait to see how far this start-up goes.

-

GAMEE

An interesting and successfully completed investment in the gaming industry, specifically in the GAMEE gaming platform — a project built by exceptional people. We participated in the exit in 2020 as a minority shareholder, when the Chinese group Animoca Brands acquired the company for a price of 130 million CZK. We currently remain shareholders of the newly established Animoca Brands, whose valuation recently exceeded $1 billion.

-

Rocher Café

We also invest in traditional fields, which is confirmed by the “off-system” investment in Rocher Café. Originally, a Czech hobby project, it has developed into a premium coffee roaster with its network of bistros. This investment smells of great coffee, great food and is backed by a bunch of smiling people who are happy to help with the concept of further development.